Are you a small business owner looking for quick and reliable funding to fuel your growth? The Kabbage application process could be the perfect solution to meet your financial needs. Kabbage, a leading online financial services company, offers a seamless and user-friendly platform designed to provide small businesses with the capital they need to thrive. With its innovative approach to lending, Kabbage has become a go-to resource for entrepreneurs seeking flexibility and convenience in securing funds. Whether you're looking to expand your operations, purchase inventory, or manage cash flow, Kabbage's application process is tailored to meet the unique demands of modern businesses.

What sets Kabbage apart from traditional lenders is its focus on speed, transparency, and accessibility. By leveraging advanced technology and data analytics, Kabbage evaluates your business's financial health in real-time, enabling you to receive funding decisions within minutes. This eliminates the lengthy paperwork and waiting periods often associated with conventional loans. Moreover, the Kabbage application is entirely online, making it accessible to business owners regardless of their location or time constraints. With just a few clicks, you can apply for funding and potentially access the resources you need to take your business to the next level.

As we delve deeper into the Kabbage application process, you'll discover how this platform can empower your business to achieve its goals. From understanding the eligibility criteria to navigating the application steps, this article will provide a comprehensive guide to help you make the most of this innovative financial tool. Whether you're a seasoned entrepreneur or just starting out, mastering the Kabbage application process can unlock new opportunities for growth and success. So, let's explore how you can harness the power of Kabbage to propel your business forward.

Read also:Unveiling The Enchanting Paradise Beach Of Cozumel A Tropical Haven

Table of Contents

- What is Kabbage Application and How Does It Work?

- Why Choose Kabbage Application Over Traditional Loans?

- A Step-by-Step Guide to Completing the Kabbage Application

- What Are the Eligibility Requirements for Kabbage Application?

- Common Mistakes to Avoid During the Kabbage Application Process

- What Are the Key Benefits of Using Kabbage Application for Your Business?

- Are There Alternatives to Kabbage Application for Business Funding?

- Frequently Asked Questions About Kabbage Application

What is Kabbage Application and How Does It Work?

The Kabbage application is a digital platform designed to streamline the process of securing funding for small businesses. Unlike traditional lenders, Kabbage uses a unique algorithm to assess the financial health of your business. This involves analyzing real-time data from various sources, such as your bank accounts, accounting software, and payment processors. By integrating these data points, Kabbage can provide a comprehensive view of your business's cash flow, creditworthiness, and overall financial stability. This approach not only speeds up the application process but also ensures that the funding decisions are based on accurate and up-to-date information.

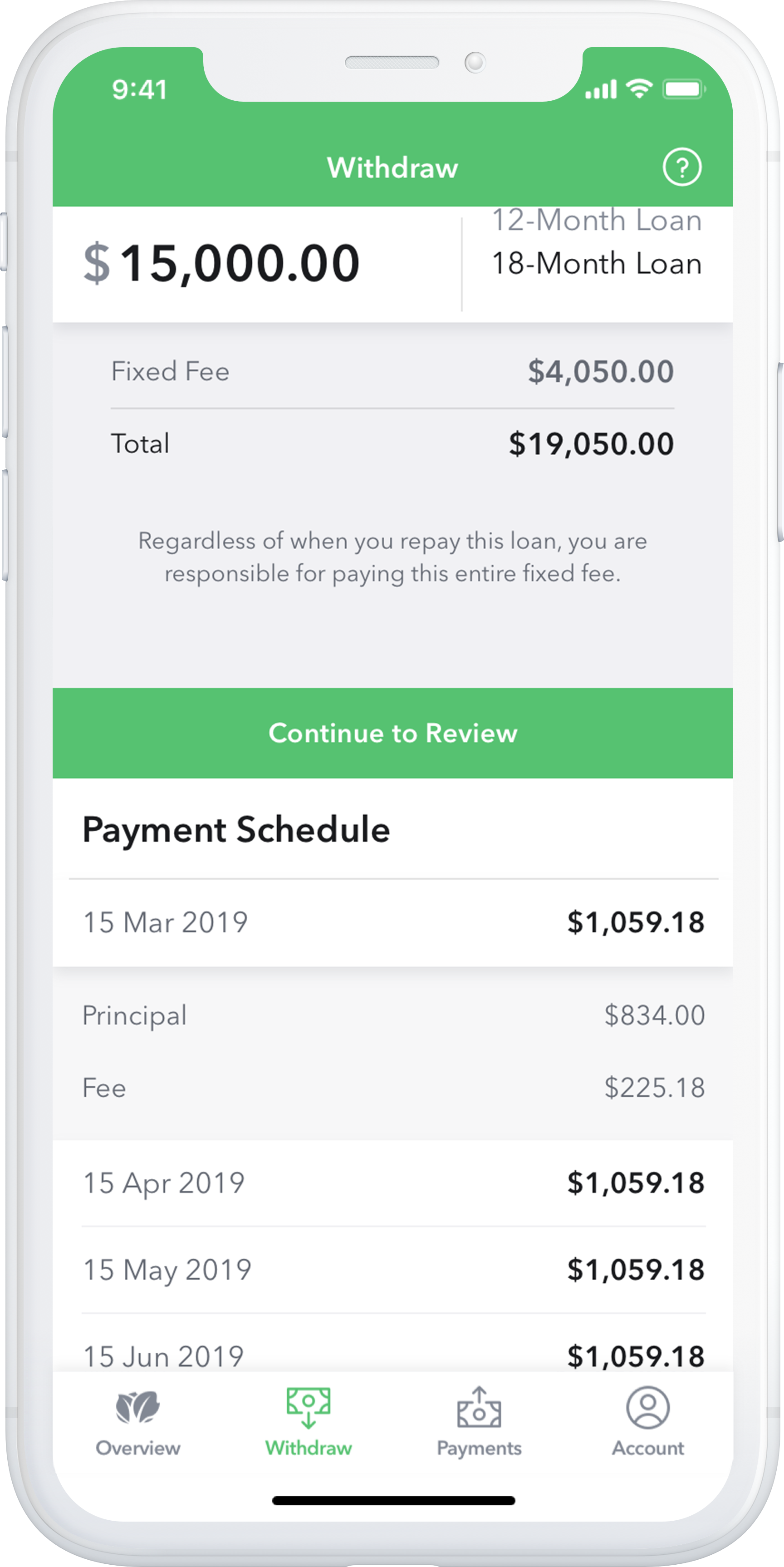

One of the standout features of the Kabbage application is its flexibility. Businesses can apply for funding ranging from $2,000 to $250,000, depending on their needs and financial standing. Once approved, funds are typically deposited into your account within 24 hours, allowing you to address immediate financial requirements. Additionally, Kabbage offers a line of credit that can be drawn upon as needed, providing businesses with ongoing access to capital without the need to reapply. This flexibility makes the Kabbage application particularly appealing to businesses with fluctuating cash flow or seasonal demands.

Key Features of Kabbage Application

- Quick Approval: Funding decisions are made within minutes, thanks to Kabbage's automated underwriting process.

- Transparent Fees: Kabbage charges a flat fee based on the amount borrowed, ensuring there are no hidden costs.

- Flexible Repayment: Repayment terms are tailored to your business's cash flow, with options to pay weekly or monthly.

- Integration with Business Tools: Kabbage connects seamlessly with popular accounting and payment platforms, simplifying the application process.

How Kabbage Differs from Traditional Lenders

While traditional lenders often rely on credit scores and lengthy documentation, the Kabbage application focuses on real-time financial data. This shift in approach allows Kabbage to cater to businesses that may not qualify for traditional loans due to limited credit history or fluctuating revenue. By emphasizing the overall health of your business rather than just credit scores, Kabbage provides a more inclusive and accessible funding option for small businesses.

Why Choose Kabbage Application Over Traditional Loans?

Choosing the Kabbage application over traditional loans can be a game-changer for small businesses seeking funding. One of the primary advantages is the speed at which Kabbage operates. Traditional loans often involve weeks or even months of waiting for approval, whereas Kabbage can provide a decision within minutes and disburse funds within 24 hours. This rapid turnaround is crucial for businesses that need immediate access to capital to seize opportunities or address urgent financial needs.

Another compelling reason to opt for the Kabbage application is its flexibility. Unlike traditional loans, which often come with rigid repayment schedules and fixed amounts, Kabbage offers a line of credit that businesses can draw from as needed. This means you only pay for what you use, and repayment terms are tailored to your business's cash flow. Additionally, Kabbage charges a flat fee based on the amount borrowed, ensuring transparency and eliminating hidden costs that are often associated with traditional loans.

Advantages of Using Kabbage Application

- No Collateral Required: Kabbage does not require collateral, making it a less risky option for small businesses.

- Minimal Documentation: The application process is streamlined, requiring only essential financial data.

- Scalable Funding: Businesses can access funding ranging from $2,000 to $250,000, depending on their needs.

- Improved Cash Flow Management: With flexible repayment options, businesses can manage their cash flow more effectively.

A Step-by-Step Guide to Completing the Kabbage Application

Completing the Kabbage application is a straightforward process, but it's important to follow each step carefully to ensure a smooth experience. The first step is to create an account on the Kabbage platform. This involves providing basic information about your business, such as its name, industry, and time in operation. Once your account is set up, you'll be prompted to link your business bank account and other financial tools, such as accounting software or payment processors. These integrations allow Kabbage to analyze your financial data in real-time, providing a comprehensive view of your business's financial health.

Read also:Exploring The Impact Delving Into The Olsen Twins Fashion Line Legacy

After linking your accounts, the next step is to complete the application form. This form will ask for details about your business's revenue, expenses, and funding needs. It's important to provide accurate and up-to-date information to ensure that Kabbage can make an informed decision about your eligibility. Once the form is submitted, Kabbage's automated system will evaluate your application and provide a decision within minutes. If approved, you'll receive an offer detailing the amount of funding available and the associated fees.

Tips for a Successful Kabbage Application

- Prepare Your Financial Data: Ensure that your bank accounts and financial tools are up-to-date before starting the application.

- Be Honest and Accurate: Providing false information can lead to delays or rejection of your application.

- Review the Offer Carefully: Understand the terms and fees associated with the funding before accepting the offer.

- Link Multiple Data Sources: Connecting additional financial tools can strengthen your application by providing a more complete picture of your business's financial health.

What Are the Eligibility Requirements for Kabbage Application?

Before diving into the Kabbage application process, it's important to understand the eligibility requirements to ensure that your business qualifies for funding. One of the primary criteria is that your business must have been in operation for at least one year. This demonstrates to Kabbage that your business has established a track record and is capable of generating consistent revenue. Additionally, your business must have a minimum monthly revenue of $4,500, which helps Kabbage assess your ability to repay the funds.

Another key requirement is that your business must operate in an eligible industry. While Kabbage serves a wide range of industries, certain sectors, such as gambling or adult entertainment, are excluded. It's also important to note that Kabbage primarily serves small businesses in the United States, although they have expanded their services to include businesses in other countries. Ensuring that your business meets these eligibility criteria is the first step toward a successful Kabbage application.

Additional Factors That Influence Eligibility

- Credit Score: While Kabbage does not have a strict credit score requirement, a higher score can improve your chances of approval.

- Business Structure: Kabbage works with sole proprietors, partnerships, corporations, and LLCs, but the application process may vary slightly depending on your business structure.

- Financial Health: Kabbage evaluates your business's cash flow, profitability, and overall financial stability to determine eligibility.

Common Mistakes to Avoid During the Kabbage Application Process

While the Kabbage application process is designed to be user-friendly, there are common mistakes that applicants often make, which can lead to delays or rejection. One of the most frequent errors is failing to provide accurate financial data. Since Kabbage relies on real-time financial information to assess your business's eligibility, submitting incorrect or outdated data can result in an unfavorable decision. To avoid this, ensure that your bank accounts and financial tools are up-to-date before starting the application.

Another common mistake is not linking all available financial tools. While Kabbage can evaluate your application with minimal data, linking additional sources such as accounting software or payment processors can provide a more comprehensive view of your business's financial health. This can strengthen your application and increase your chances of approval. Additionally, some applicants rush through the application without carefully reviewing the terms and fees associated with the funding. Taking the time to understand the offer can help you make an informed decision and avoid unexpected costs.

How to Avoid These Mistakes

- Double-Check Your Data: Ensure that all financial information is accurate and up-to-date before submitting your application.

- Link All Relevant Accounts: Connect as many financial tools as possible to provide a complete picture of your business's financial health.

- Read the Terms Carefully: Take the time to review the funding offer, including fees and repayment terms, before accepting.

What Are the Key Benefits of Using Kabbage Application for Your Business?

Using the Kabbage application for your business funding needs offers several key benefits that make it a preferred choice for many entrepreneurs. One of the most significant advantages is the speed and convenience of the application process. Unlike traditional lenders, which often require extensive paperwork and lengthy approval times, Kabbage provides funding decisions within minutes and disburses funds within 24 hours. This rapid turnaround is invaluable for businesses that need immediate access to capital to seize opportunities or address urgent financial needs.

Another major benefit is the flexibility that Kabbage offers. With a line of credit that can be drawn upon as needed, businesses have ongoing access to funding without the need to reapply. This flexibility is particularly beneficial for businesses with fluctuating cash flow or seasonal demands. Additionally, Kabbage's transparent fee structure ensures that there are no hidden costs, allowing businesses to plan their finances with confidence. These benefits, combined with Kabbage's focus on real-time financial data, make it an attractive option for small businesses seeking funding.

Why Businesses Prefer Kabbage Application

- Quick Access to Funds: Businesses can receive funding decisions within minutes and access funds within 24 hours.

- Flexible Repayment Options: Repayment terms are tailored to your business's cash flow, providing greater flexibility.

- Transparent Fees: Kabbage charges a flat fee based on the amount borrowed, ensuring no hidden costs.

- Ongoing Access to Capital: With a line of credit, businesses can draw funds as needed without reapplying.

Are There Alternatives to Kabbage Application for Business Funding?

While the Kabbage application is a popular choice for small business funding, it's important to explore alternatives to ensure that you're selecting the best option for your needs. One alternative is traditional bank loans, which often offer