With its innovative approach to credit assessment and funding, Kabbage has carved a niche for itself in the financial industry. This platform leverages technology to streamline the loan application process, enabling small business owners to secure funds quickly and efficiently. Whether you're a startup looking for seed capital or an established business seeking working capital, Kabbage lending provides a range of financial products designed to support your growth journey. In today’s fast-paced business environment, access to timely funding can make all the difference between success and stagnation. Kabbage lending addresses this critical need by offering a user-friendly platform that evaluates business performance using real-time data. By analyzing metrics such as sales, cash flow, and transaction history, Kabbage provides a holistic view of a business’s financial health, ensuring that loans are disbursed based on accurate and up-to-date information. This approach not only simplifies the borrowing process but also empowers business owners to make informed financial decisions. As we delve deeper into the world of Kabbage lending, this article will explore its features, benefits, and how it compares to traditional lending options. From understanding the eligibility criteria to evaluating the pros and cons, we aim to equip you with the knowledge needed to determine whether Kabbage lending is the right choice for your business. By the end of this guide, you’ll have a clear understanding of how Kabbage lending can support your entrepreneurial ambitions while aligning with your financial goals.

Table of Contents

- What is Kabbage Lending and How Does It Work?

- How Does Kabbage Lending Differ from Traditional Loans?

- Who is Eligible for Kabbage Lending?

- What Are the Benefits of Kabbage Lending?

- How to Apply for a Kabbage Loan?

- What Are the Potential Drawbacks of Kabbage Lending?

- Is Kabbage Lending Right for Your Business?

- Frequently Asked Questions About Kabbage Lending

What is Kabbage Lending and How Does It Work?

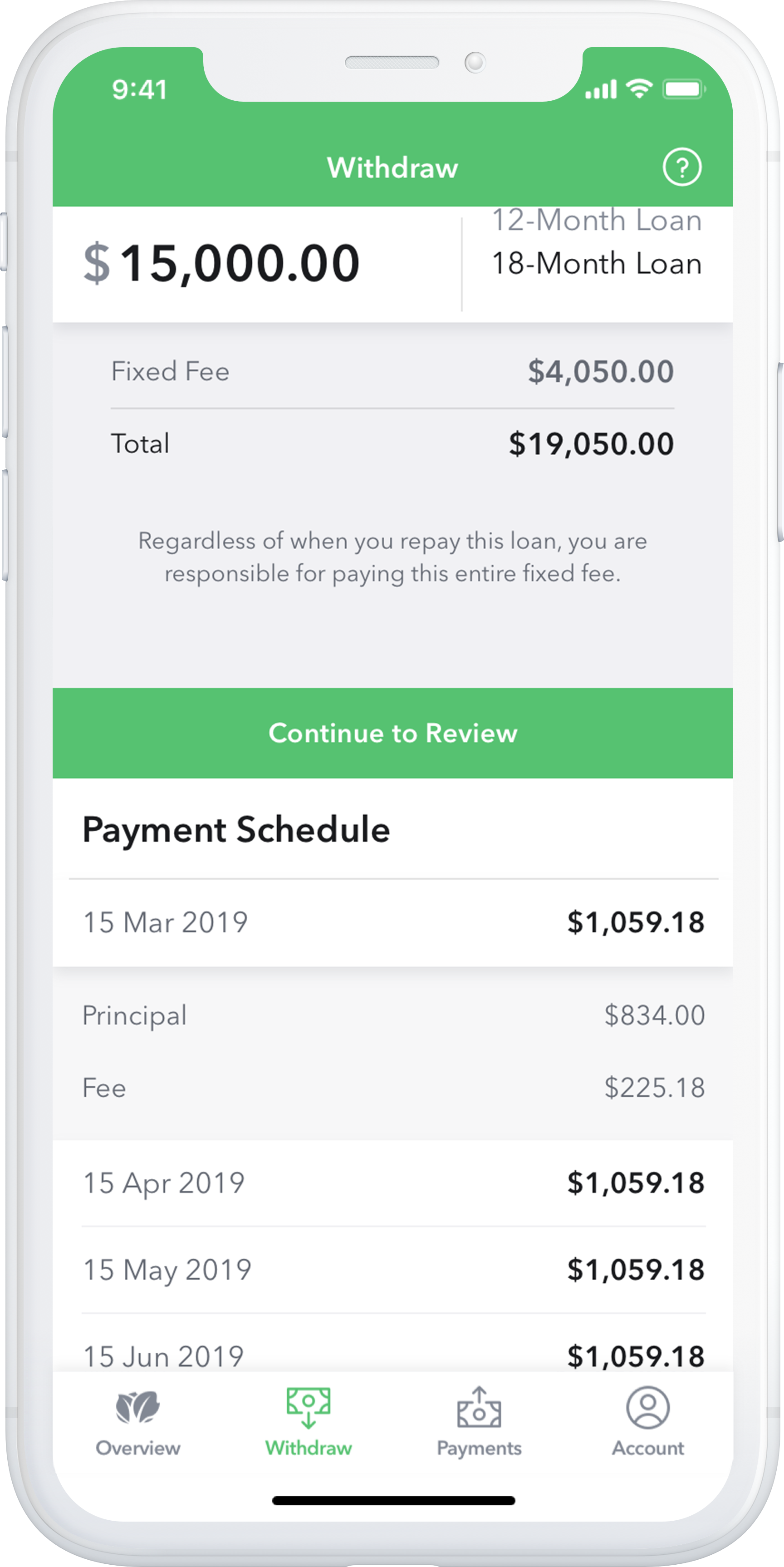

Kabbage lending operates on a unique model that sets it apart from conventional lending institutions. At its core, Kabbage leverages technology to assess the financial health of small businesses through real-time data analysis. Instead of relying solely on credit scores, Kabbage evaluates a wide range of factors, including bank account activity, accounting software records, and even e-commerce platform performance. This data-driven approach ensures that the lending decision is based on a comprehensive understanding of the business’s current operations and future potential. To begin the process, business owners must create an account on the Kabbage platform and connect their financial accounts. This step allows Kabbage to access transactional data, which is then analyzed to determine the business’s eligibility for funding. Once the assessment is complete, Kabbage provides a funding offer tailored to the business’s needs. The funds can be accessed in as little as 24 hours, making it an ideal solution for businesses requiring immediate capital to address cash flow gaps or seize growth opportunities. Another key feature of Kabbage lending is its flexibility in repayment terms. Borrowers can choose from various repayment schedules, allowing them to align their financial obligations with their cash flow cycles. Additionally, Kabbage offers a line of credit, which enables businesses to draw funds as needed, paying interest only on the amount utilized. This flexibility not only reduces financial strain but also ensures that businesses can manage their funds efficiently while focusing on growth and innovation.

How Does Kabbage Lending Differ from Traditional Loans?

When comparing Kabbage lending to traditional loans, the differences are both significant and impactful for small business owners. Traditional loans, typically offered by banks and credit unions, often involve a lengthy and cumbersome application process. These institutions rely heavily on credit scores, collateral, and extensive documentation to assess eligibility. In contrast, Kabbage lending simplifies the process by utilizing real-time data and technology, enabling businesses to secure funds quickly without the need for collateral. One of the most notable distinctions is the speed at which funds are disbursed. Traditional loans can take weeks or even months to process, as they involve multiple layers of approval and verification. Kabbage lending, on the other hand, leverages automated systems to evaluate applications and disburse funds within 24 hours. This rapid turnaround is particularly beneficial for businesses facing urgent financial needs, such as inventory restocking or unexpected expenses.

Read also:Unveiling The Mysteries Chinese Horoscope 1984 A Deep Dive Into The Year Of The Wood Rat

What Are the Key Advantages of Kabbage Lending Over Traditional Loans?

Kabbage lending offers several advantages that make it an attractive alternative to traditional loans. First and foremost is its accessibility. Unlike banks, which often have stringent eligibility criteria, Kabbage caters to a broader range of businesses, including those with less-than-perfect credit histories. By focusing on real-time performance metrics, Kabbage provides opportunities for businesses that might otherwise struggle to secure financing. Another advantage is the transparency of the Kabbage lending model. Borrowers can access detailed insights into how their eligibility is assessed, fostering trust and confidence in the process. Additionally, Kabbage’s flexible repayment options allow businesses to tailor their financial commitments to their unique cash flow patterns. This flexibility is a stark contrast to the rigid terms often associated with traditional loans, making Kabbage lending a more adaptable solution for modern entrepreneurs.

Who is Eligible for Kabbage Lending?

To determine whether you qualify for Kabbage lending, it’s essential to understand the platform’s eligibility criteria. While Kabbage is known for its inclusive approach, certain requirements must be met to access its financing options. First and foremost, applicants must operate a business that has been active for at least six months. This ensures that Kabbage can evaluate the business’s financial performance based on a sufficient track record.

What Documents Are Required for Kabbage Lending?

The application process for Kabbage lending is relatively straightforward, but it does require specific documentation to verify the business’s financial standing. Applicants must provide access to their business bank accounts, which allows Kabbage to analyze transaction history and cash flow. Additionally, businesses may need to connect their accounting software, such as QuickBooks or Xero, to provide a comprehensive view of their financial operations. For e-commerce businesses, linking platforms like Shopify or Amazon can further strengthen the application.

Are There Any Restrictions on the Types of Businesses Eligible for Kabbage Lending?

While Kabbage lending is designed to support a wide range of industries, there are some restrictions to be aware of. For instance, businesses in high-risk industries, such as gambling or adult entertainment, may not qualify for funding. Additionally, Kabbage primarily serves small to medium-sized enterprises, meaning large corporations may need to explore alternative financing options. Understanding these limitations can help business owners assess whether Kabbage lending aligns with their needs.

What Are the Benefits of Kabbage Lending?

Kabbage lending offers a host of benefits that make it a preferred choice for many small business owners. One of the most significant advantages is its speed and convenience. Unlike traditional lenders, which often require weeks of processing, Kabbage provides funding in as little as 24 hours. This rapid access to capital is invaluable for businesses facing time-sensitive opportunities or challenges, such as seasonal inventory purchases or emergency repairs. Another key benefit of Kabbage lending is its flexibility. Borrowers can choose from various repayment terms and access a revolving line of credit, allowing them to draw funds as needed. This flexibility ensures that businesses only pay interest on the amount they utilize, reducing unnecessary financial strain. Additionally, Kabbage’s data-driven approach to credit assessment provides a more accurate reflection of a business’s financial health, enabling fairer lending decisions.

How to Apply for a Kabbage Loan?

Applying for a Kabbage loan is a straightforward process designed to minimize hassle and maximize efficiency. The first step is to create an account on the Kabbage platform, which requires basic information about your business. Once registered, you’ll need to connect your financial accounts, such as your business bank account and accounting software. This connection allows Kabbage to analyze your financial data and assess your eligibility for funding. After the initial assessment, Kabbage will provide a funding offer based on your business’s performance metrics. If you accept the offer, the funds can be disbursed to your account within 24 hours. Throughout the process, Kabbage maintains transparency, ensuring that borrowers understand how their eligibility is determined and what terms they are agreeing to. This user-friendly approach makes Kabbage lending an accessible option for businesses of all sizes.

Read also:Unveiling The Wealth Of Maurice Benard A Deep Dive Into His Net Worth

What Are the Potential Drawbacks of Kabbage Lending?

While Kabbage lending offers numerous advantages, it’s important to consider potential drawbacks before committing to this financing option. One common concern is the cost of borrowing. Kabbage’s fees and interest rates can be higher than those of traditional loans, particularly for businesses with lower credit scores. This makes it essential for borrowers to carefully evaluate the total cost of financing and ensure it aligns with their budget. Another potential drawback is the reliance on technology. While Kabbage’s data-driven approach is a significant advantage, it also means that businesses with limited digital footprints may face challenges in securing funding. Additionally, some borrowers may find the repayment terms less flexible than expected, particularly if their cash flow fluctuates unpredictably. Understanding these limitations can help businesses make informed decisions about whether Kabbage lending is the right fit for their needs.

Is Kabbage Lending Right for Your Business?

Determining whether Kabbage lending is the right choice for your business requires careful consideration of your financial needs and goals. For businesses that prioritize speed and flexibility, Kabbage’s innovative approach to lending can be a game-changer. Its ability to provide rapid access to capital and tailor repayment terms to cash flow cycles makes it an ideal solution for entrepreneurs seeking agility in their financial management. However, businesses with stable cash flow and strong credit histories may find traditional loans to be a more cost-effective option. Additionally, those operating in industries with limited digital footprints may face challenges in meeting Kabbage’s eligibility criteria. By weighing these factors, business owners can make an informed decision about whether Kabbage lending aligns with their long-term financial strategy.

Frequently Asked Questions About Kabbage Lending

What Types of Businesses Are Best Suited for Kabbage Lending?

Kabbage lending is particularly well-suited for small to medium-sized businesses that require quick access to capital. Industries such as retail, e-commerce, and service-based businesses often benefit from Kabbage’s flexible funding options. However, businesses with inconsistent cash flow or those in high-risk industries may need to explore alternative financing solutions.

How Does Kabbage Determine Loan Amounts?

Kabbage determines loan amounts based on a comprehensive analysis of a business’s financial performance. Factors such as monthly revenue, transaction history, and cash flow patterns are evaluated to assess eligibility and determine the funding limit. This data-driven approach ensures that loan amounts are tailored to each business’s unique needs and capabilities.

Can I Pay Off My Kabbage Loan Early?

Yes, Kabbage allows borrowers to pay off their loans early without incurring prepayment penalties. This flexibility enables businesses to reduce their overall borrowing costs and improve their financial standing. By paying off the loan ahead of schedule, borrowers can also free up their line of credit for future use.

In conclusion, Kabbage lending offers a modern and innovative approach to small business financing, empowering entrepreneurs to achieve their goals with confidence. By understanding its features, benefits, and potential drawbacks, business owners can make informed decisions about whether this platform aligns with their financial needs. For further insights into small business financing, you can explore resources like the U.S. Small Business Administration.